Understand your Motivation for Buying a Home

Before you start looking at houses or thinking about loans, it’s important to understand why you want to buy a home. Most people have two main reasons — financial and personal.

Financial reasons include things like building wealth, saving on taxes, and having steady housing costs instead of rising rent. Personal reasons might be wanting more space, freedom, or a sense of stability. Knowing what motivates you will help you make smarter choices about how much to spend, where to buy, and what kind of home fits your goals.

Financial Reasons to Buy Real Estate

1) More Stable Housing Costs

Rent payments can be unpredictable and typically rise each year, but most mortgage payments remain unchanged for the entire loan period. If property taxes go up, the increase is usually gradual.

This stable housing costs are especially important in times of inflation, when renters lose money and owners make money.

2) Appreciation

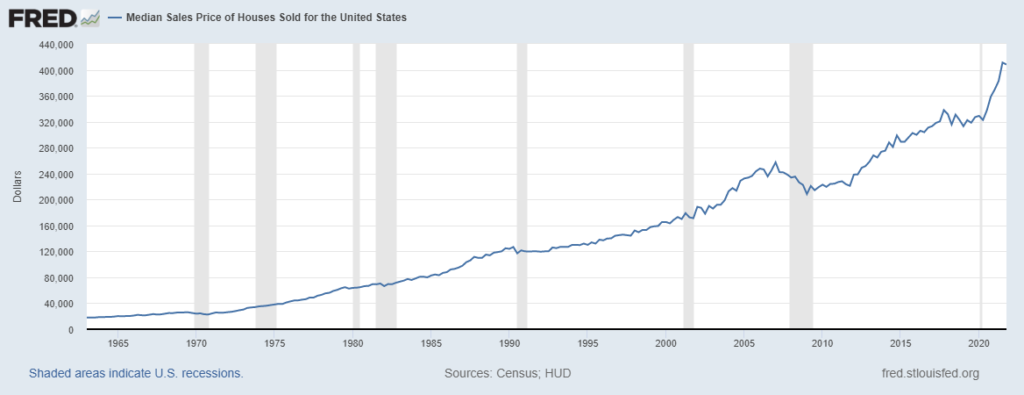

Homes typically increase in value (or appreciate) over time. The Median Home Sales price in the United States has risen steadily since 1965 with the exception of 2008 and 2018. According to Millionacres.com, the current USA average appreciation rate is 2% month over month and 14.5% year over year

3) Tax Savings

Homeowners can be eligible for significant tax savings because you can deduct mortgage interest and property taxes from your federal income tax, as well as many states’ income taxes. This can be a considerable amount of money at first, because the first few years of mortgage payments is made up mostly of interest and taxes.

4) Additional Income

If you own your own home, it also opens doors for renting out a spare room on AirBnB or Vrbo (short-term rentals) or even renting out on a longer-term basis if you have empty room, or guest area or a basement that you can convert.