You’ll learn how to increase your Credit in 30 Days.

Get your credit report

Did you know that Credit score is typically the biggest factor in determining interest rates?

A credit score is a number between 300–850 that depicts a consumer’s creditworthiness. The higher the score, the better a borrower looks to potential

You can get your credit score from the following companies for free

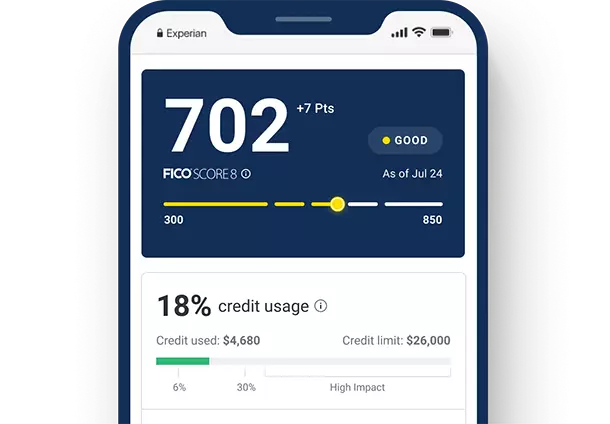

- Experian – Get your credit report, FICO score, for free. No credit card needed.

- Rocket Credit Score

- MyFico

- Equifax

What should you do if you have a low credit score?

A low credit score makes it harder to get a credit card or mortgage—and if do get one you will pay higher interest rates.

Repairing your credit score takes time. Thankfully, there are several companies that can help you improve your score.

- RentReporters helps you increase your credit score by reporting on-time rental payment history to the credit bureaus. After adding their rent to their credit file, customers have been an average credit score increase of 40 points in 10 days.

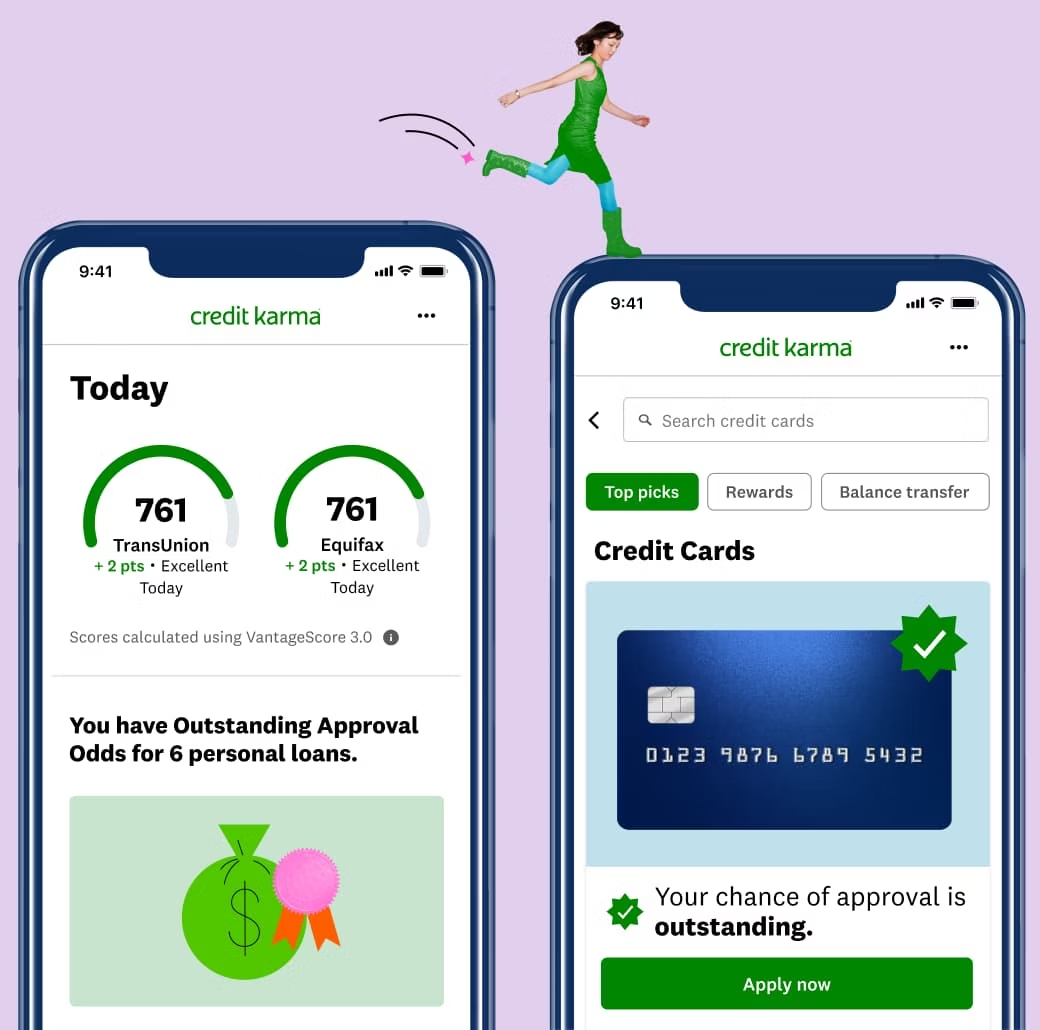

- Credit Karma uses your credit profile to show you curated credit offers for loans and credit cards. Plus, with Karma Confidence, you can see your Approval Odds before you apply, without impacting your scores.

- National Debt Relief provides free, no-obligation debt relief consultation.