Rental properties are a great way to create wealth and passive income. According to Forbes, “With long-term appreciation, a monthly cash-flow and tax advantages, owning and operating rental properties will increase your wealth so you can save for retirement, life events or for other reasons.”

The secrets (sorry, but I’m gonna share a few here) are determining if your investment is really generating income and is it a passive activity.

#1 Known your “simple” expected return of capital (capitalization rate)

Here’s a simple formula to judge if a real estate investment is a good one that will generating income .

Let’s assume you borrowed $120,000 for your property. You collect rent from long term or short term rentals in exchange for providing them a safe place to stay. If your rental income for the year is $7000 and your $1000 in expenses (insurance, taxes, repair costs) then your net rental income is $6,000 ($7000-$1000).

In this example, 5% is our expected return of capital based on our net rental income of $6,000 and capital of $120,000.

5% may not sound like a great return but its 5x-10x more than your typical savings account giving you less than 1%.

According to Forbes, “A good ROI for a rental property is usually above 10%, but 5% to 10% is also an acceptable range. “

Before you buy a property, evaluate if it will be a good return on capital? There could be other lower risk investments that can provide a 5% return and provide capital appreciation without requiring a large capital investment, debt and the complexity of property management.

Stocks are a great alternative to rental properties. Stocks provide monthly income through dividends and capital appreciation through increases in stock value.

Stocks are more fluid investments. They can also be easily and quickly sold and bought almost at anytime — unlike a rental property.

Real Estate Exchange Trade Funds are stocks where you buy ownership (shares) of real estate assets such as commercial, industrial, and retail properties. Each share that you own, entitles you to receive a dividend paid on a monthly or quarterly basis.

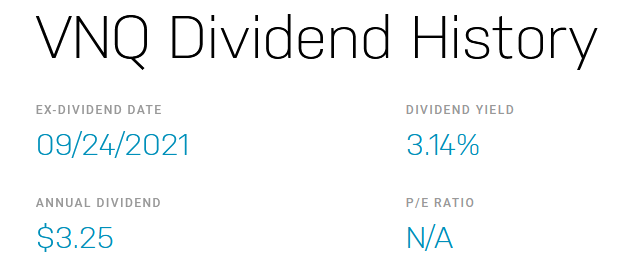

Vanguard Real Estate Exchange Traded Fund (VNQ) is one of the most popular exchange traded funds on the market today. VNQ pays a annual dividend of $3.18 per share. This equates to an average return on capital of 3.14% (2021).

Ownership is passive — you don’t have to do anything after purchasing the stock to receive dividends. All underlying properties are completely managed by the fund.

All investments involve some level of risk such as market down turns.

Read More: Earn truly Passive Income through Real Estate Exchange Traded Funds

How can you improve you rental income?

Increasing you rental income is an easy way to improve your return non capital. Generally you can increase you rental income by either charging more for rent or lowering your monthly expenses.

To understand how much to charge for rent, use tools like Rentalizer

Rentalizer allows you to enter any address in the world, and access annual revenue, ADR and occupancy projections based on historical data, competitor index, and market revenue growth.

Could there a better neighborhood, cities, or even state where you can charge higher rents on a lower cost property.

Imagine owning two houses costing $60,000 a piece and both generating $6,000 a year in income.

#2: Make your business passive

Passive investments ideally require a significant amount of up-front time investment followed by much longer periods of inactivity.

Consider how much time you spend on your rental properties? Are you spending 5 or more hours a month managing and maintaining your rental property

For you rental to become truly passive create a system and processes such that management of rental properties can be completely outsourced to either property management companies or semi-automated.

Automating routine expected tasks such as paying quarterly property taxes, mortgage payments, lawn care, sending rent payment reminders saves your time.

These automations enable you to generate truly passive income without consuming your precious time.

A system to follow for buying rental properties

With in-depth advice, The Book on Rental Property Investing imparts practical and exciting strategies that real estate investors across the world are using to build significant cash flow with rental properties.

Brandon Turner is active real estate investor, best-selling author, and co-host of the BiggerPockets Podcast – breaks down the time-tested strategies he used to build his own wealth in real estate.

Click here to play a sample a sample from The Book on Rental Property Investing8 Step Blueprint for success

Brandon shares a simple blueprint for purchasing rental properties including advice on keeping your wealth by deferring (and eliminating) taxes:

- Make a Plan

- Choose Your Market

- Build Your Team

- Figure out Your Financing

- Start Getting Leads

- Start Analyzing Deals

- Offer and Negotiate

- Close and Manage

Whether you are just getting started or already own hundreds of units, you will learn how to create an achievable plan, find incredible deals, analyze properties, build a team, finance rentals, and much more – everything you need to become a millionaire rental property investor.