Are you thinking about buying your first home? We have information that can help! Our First Time Buyers Checklist can help you start and track on your journey to real estate ownership.

Overview

Owning your home is the most common and well-known real estate investment. You don’t get cash flow from tenants but you make money from the appreciation of your home value when it is sold it in the future.

Summary of Home Ownership as an financial investment

- Up-Front Investment: High. A down payment of usually 10% to 20% of home’s price.

- Return on investment: Varies. Market conditions determine how much you can sell for in the future.

- Duration: Most mortgages last 15 to 30 years, however you can fix and flip distressed properties much faster.

- Liquidity: Low, it is difficult to sell a home quickly but you can get loans against its principle if you need cash

- On-Going Investment: Monthly mortgage payment, property maintenance are required

- Best for: Investors who can afford large up-front investment, and sees a strong market in the local area.

Understand your Motivation for Buying a Home

Before beginning, you should take some time to understand your motivations for buying your first home. Motivations generally fall into two categories: Financial and Non-Financial

Financial Reasons to Buy Real Estate

1) More Stable Housing Costs

Rent payments can be unpredictable and typically rise each year, but most mortgage payments remain unchanged for the entire loan period. If property taxes go up, the increase is usually gradual.

This stable housing costs are especially important in times of inflation, when renters lose money and owners make money.

2) Appreciation

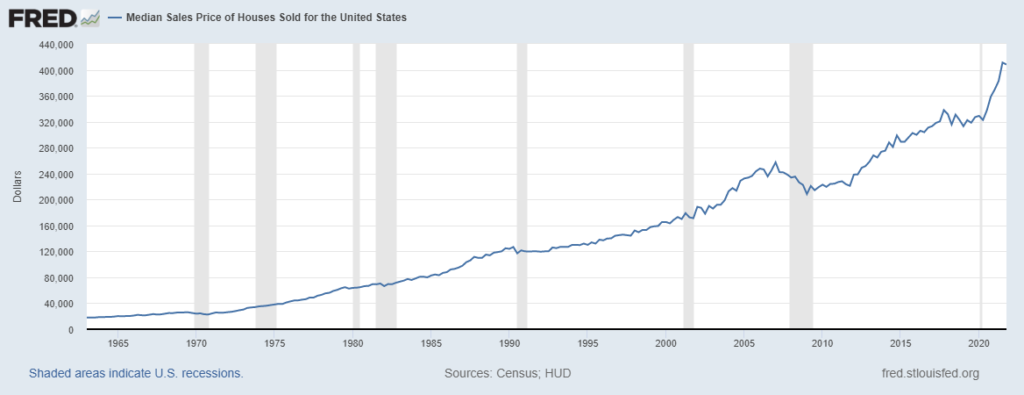

Homes typically increase in value (or appreciate) over time. The Median Home Sales price in the United States has risen steadily since 1965 with the exception of 2008 and 2018. According to Millionacres.com, the current USA average appreciation rate is 2% month over month and 14.5% year over year

3) Tax Savings

Homeowners can be eligible for significant tax savings because you can deduct mortgage interest and property taxes from your federal income tax, as well as many states’ income taxes. This can be a considerable amount of money at first, because the first few years of mortgage payments is made up mostly of interest and taxes.

4) Additional Income

If you own your own home, it also opens doors for renting out a spare room on AirBnB or Vrbo (short-term rentals) or even renting out on a longer-term basis if you have empty room, or guest area or a basement that you can convert.

Read more: Deciding if you are ready to buy a home >>

10 Steps to Buy your First Home

The home buying process consist of the following 10 steps. Most buyers can expect to spend around 6 months purchasing their first home so its important not to waste time.

Click any of the steps below to get more information.

- Plan you Budget

- Choose A Lender and Get Preapproved For A Mortgage

- Build your Team

- Search for a Home

- Make an Offer

- Get a Home Inspection

- Get a Home Appraisal

- Get Home Owner’s Insurance

- Ask Seller to Fix Issues and Final Walk through

- Close on Your New Property

Next Step: Plan Your Budget

You can also use our First Time Buyers Checklist to track and record your progress and next steps.