Real Estate is a great way to create passive income and other benefits such as capital appreciation and tax benefits.

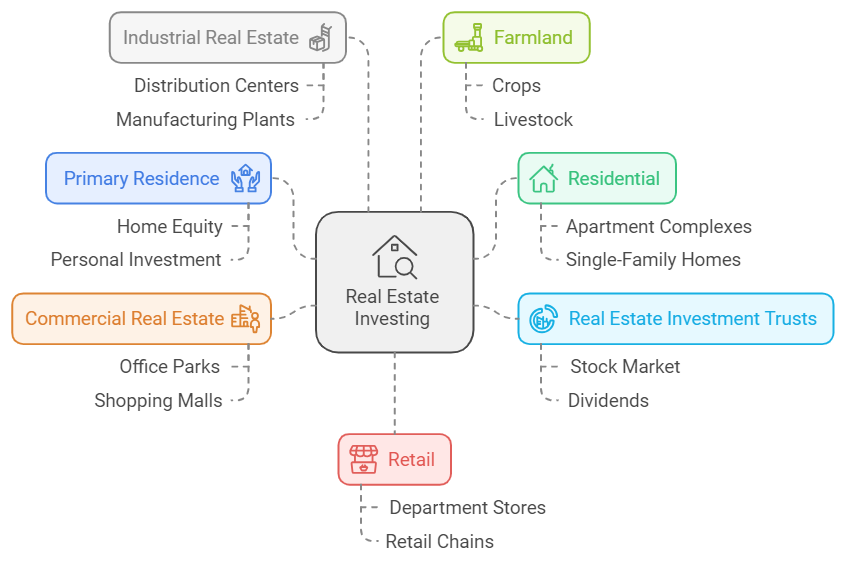

Real Estate investing is typically divided into the following major categories:

- Primary Residence

- Residential

- Real Estate Investment Trusts

- Commercial Real Estate

- Industrial Real Estate

- Farmland

- Retail

Examples of each category are shown in the diagram below

Primary Residence

Owning your home is the most common and well-known real estate investment. You don’t get cash flow from tenants but you make money from the appreciation of your home when it is sold it in the future.

Click here to: Get Started with Buying your First Home

Residential Real Estate

You get cash flow for allowing people to temporarily living in, or rent a residential property owned by you. You pay your mortgage using rental come and the property appreciates up in value over time.

Short term rentals provide lodging for a short as day to as long as several weeks to individuals travelers or families. You can rent out a couch, single bed rooms or an entire house.

Like a hotel, you’ll be responsible for providing a clean and safe living space, addressing issues (lost keys, lock-outs, pest control), furnishing, cleaning, and repairing any damages made to the property.

Short term rentals are advertised on sites such as Craiglist, Airbnb and Vrbo.

Sounds great. But how much money can you make?

Tools such as AirDNA that allow you to estimate how much money a property can earn based on several factors such as its location, amenities, occupancy rate and seasonality.

After you’ve completed researching how much revenue your property can earn, then you’ll know with confidence if it is worth your time renting out your property.

Interested in learning more about Short Term Rentals? Read these articles to learn more:

- How to Get Started with AirBnb

- How much money can you earn with AirBnb

- 5 Ways to Maximize Airbnb Revenue

- How much money could you make renting on Vrbo

Real Estate Investment Trusts

You buy shares of a real estate company that owns, manages, and leases real estate properties such as apartment buildings, commercial or retails space.

These companies are referred to as an Real Estate Investment Trusts (REITs) and they are required by law to return up to 100% of all rental income to its shareholders in the form of a dividend. See investor.gov for more details

REITs generates income through collecting rent and other fees just like a traditional landlord. You receive income from the REIT in the form of dividends paid monthly, quarterly or even yearly.

Did you know that REITs pay up to 12% in dividends? Read Buying Real Estate Investment Trust to discover which ones.

Where can you buy REITs?

You can buy REITs through an online broker. If you’re a beginner investor, find a broker that is user friendly, trustworthy and has no commission fees. Here are some popular options:

- M1 Finance – Commission Free trades and access to Premiere Real Estate Investment Trusts.

- Webull – Sign-up today and get 2 free stocks

- Ameritrade – A trusted online broker for over a decade.

- Diversity Fund – Real Estate Investment Trust focused on Multi-family properties.

More: Learn more about Real Estate Investments Trusts

Commercial Real Estate

These are buildings leased to small, medium or even businesses for the purpose of running a business. The lease agreements usually last for several years. The amount of rent payable is calculated per square meters.

Industrial Real Estate

Warehouses, factories, distribution centers, chemical factories are considered industrial real estate investment. They often restricted to specific areas of a town due to and potentially require significant revenue as an investment.

The leases are generally long-term due to the amount of build-out required to support the business and specific engineering requirements such as power, heat, and cooling.

Additional investments that you can make under industrial real estate are ancillary revenue streams such as car wash machines, dispensing machines etc.

Next Steps: Learn how to buy Industrial Real Estate Properties through Real Estate Exchange Traded Funds

Retail Real Estate

Shopping malls, multi-use buildings, retail storefronts etc. fall under this category of real estate investment. Apart from the base rent agreed between the landlord (investor) and the tenant, additional money generated from sales by the property’s occupant can be remitted to the investor’s account.

Most investors in this category look for an anchor tenant (usually a big supermarket) to drive traffic into the building.

Next Steps: Buy Retail Properties through Real Estate Exchange Traded Funds

Mixed-use Real Estate

This is a combination of commercial, industrial and, residential real estate. Investors in this segment want to diversify their options of potential occupants. You will have an anchor tenant such as a restaurant and followed by other businesses such as insurance firms, banks, shopping stalls etc.

Farm Land

Often overlooked by real estate investors, farm land can generate both passive, active income, and capital appreciation for decades

The number one benefit with buying farming land is the potential for on-going income. Farm land can generate steady income by leasing land and providing services for decades.

Farm land is also often overlooked by other real estate investors as they tend to focus on commercial or residential space. Lowered competition means the chance to purchase for at or below fair market value, giving you the potential for larger returns.

Continue reading about Farm Land Investing

Lending Money to Real Estate Investors

This is known as Crowdfunding and it involves lending money to investors in return for a percentage of the rental income. You’ll be one of several owners of the property.

Next Steps for beginners

Now you have a basic understanding of real estate investments types and their pros and cons.

Which ones interest you the most? Click any of the links below to learn more

- Primary Residence – Your largest and potentially most profitable long term investment

- Short Term Rentals

- Real Estate Investment Trusts

- Farmland

- Real Estate Exchange Traded Funds