Real Estate Investment Trust (REITs) allow you to enjoy the income from owning real estate investing without hassle of buying and managing. REITs are very similar to stocks but for real estate!

Overview

REITs are a passive investment, requiring little low-capital way to get into the real estate market.

If you want to get into real estate but don’t have the capital for a down payment, or don’t want to deal with a property, tenants and other headaches then keep reading.

- Best for: Anyone looking for a passive and flexible investment strategy.

- Up-Front Investment: You can start with any amount. The cheapest REITs have 1 share for less than $10. Don’t expect to make much with $10 though.

- On-Going Investment: None, unless you choose to keep adding money to your portfolio.

- Dividend rates are also climbing right now (up to 8% for some REITs).

Why Real Estate Investment Trusts Exist

REITs were created in the 1960s by Congress to give every individual a chance to benefit from income-producing real estate investments.

Just like you can buy shares in a company like Apple, you can also buy shares of real estate portfolios which are called REITs.

How Do REITs Work?

There are companies out there that buy lots of real estate and some of those companies create a REIT which can be traded on the stock market.

If you purchase shares of a Real Estate Investment Trust you will be a very small owner of that real estate portfolio.

There are many REITs you can choose from and some of them cost as little as a few dollars. All of them are some form of real estate properties.

Is real estate investment trust a good investment?

If you own shares in a Real Estate Investment Trust you will receive income in the form of dividends. The dividends are profits from the rental income and appreciation of the properties.

By law, at least 90% of all income earned by a REIT must be distributed to shareholders (you!). These distributions or dividends can be issued to shareholders on a monthly, quarterly, or annual basis.

There are many REITs out there but dividends can pay you anywhere from 1%-8% every year. This means you earn money just for being a shareholder, it is truly passive income.

Worried about a recession? Protect your portfolio. Invest in apartments today!You can also make money from capital appreciation. For example, if you buy your REIT at $3 it could be worth $5 next year. Obviously, it could also go down in value.

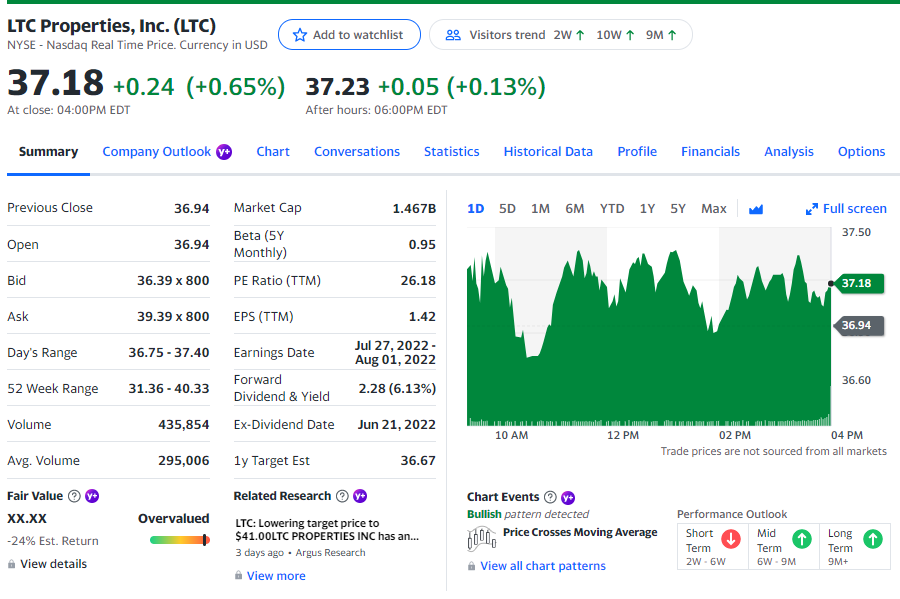

You can learn more details about individual REITS through tools such as Yahoo finance to. Below is a snapshot for LTC Properties

When buying a REIT you should also consider its expense ratio, payout schedule (usually monthly or quarterly) and cash flow.

In short, you can generate significant passive income with Real Estate Investments Trust through capital appreciate and dividends but it will take time.

What are the best dividend Real Estate Investment Trusts?

You may be interested in knowing which REITs pay the highest dividends. According to dividend.com these are the top 5 REITs for dividends:

- DiversyFund Growth REIT – 8-12%

- Realty Income Corporation (O ) – 3.9%

- Chatham Lodging Trust (CLDT) – 5.4%

- EPR Properties (EPR) – 7.1%

- LTC Properties Inc – 5.8%

- Stag Industrial (STAG ) – 3.8%

Where can I Buy REITs

To buy REITs you need to open a brokerage account. There are MANY brokerages that come in all shapes and sizes.

If you’re a beginner, find one that is user friendly, trustworthy and has no commission fees. Here are some popular options by country:

- 🇺🇸 M1 Finance – Commission Free trades and access to Premiere Real Estate Investment Trusts.

- 🇺🇸 WellBull – Sign-up today and get two free stocks.

- 🇺🇸 Diversity Fund – Real Estate Investment Trust focused on multi-family cash-flowing properties (specifically apartment buildings between 100-200 units).

- 🇭🇰TD Ameritrade – Commission Free, available in Hong Kong

- 🇭🇰 Passfolio – #2 Rated online broker in Hong Kong.

- 🇿🇦 eToro – UK and South Africa Trading Platform For Commission Free Stock Trading

- 🇨🇦 WealthSimple Trade – Bonus $5 free when you buy $100 worth of stocks/ETFs

- 🇮🇳 Zerodha – India’s most popular broker

Remember to always do your research before investing or signing-up for any service.

What are the advantages of a real estate investment trust?

- Provides regular income through dividends

- Doesn’t take a lot of time to manage. Set it and forget it

- Real Estate typically performs better than regular stocks and the stock market

- It’s naturally a diversified investment. A good protect against stock market volatility

- Let’s you invest in real estate without lots of capital, $500 to start

- It’s liquid. You can buy/sell/withdrawal your money whenever you want

What are the disadvantages of a real estate investment trust?

- Slow growth, it won’t make you rich overnight.

- You still don’t own any real estate physically

- No investment is a sure thing

Real Estate Investment Trust Summary

Real Estate Investment Trusts are a great way to invest in the real estate market without requiring large amounts of capital and without the complexity of buying property.

There are other passive real estate investments such as Tax liens, Real Estate Exchange Trade Funds and Real Estate Notes that you should also researched and considered.

It’s also not how you’re going to get rich quick it’s definitely a long term strategy. However, by getting dividends it is a true source of passive income which makes it a great option to invest for your future.

Next Steps

Want to learn more about investing in stocks such as Real Estate Investment Trusts? Our course will teach you how to research stock and make your first winning trade.

Related: Invest in Top Rated Real Estate for free on M1 Finance.