Now that you understand your motivation for purchasing property, you need to understand your current financial situation. This will allow you to determine how much you can safely spend without putting yourself at risk

Why is budget planning import?

Most experts agree that your mortgage payment should be no larger than 28% of your monthly income.

Why does my financial situation matter?

Loan companies will review your financial record to determine how much house you can safely afford and their risk based on your income, debt, credit history and credit score.

How do I calculate my Budget

To fully understand your budget and more importantly how much house you can afford to buy, perform the following steps:

- Monthly income

- Current debts and monthly bills

- Determine how much of down payment you can make

- Your credit report

Determine your monthly income

Loan officers will review your financial record to determine how much house you and afford and their risk based on your income and debt.

Income for most people comes in the form of one of more of the following:

- Employment

- Stocks, mutual funds

- Saving account

- Checking account

- Certificates of deposit (CD),

Gather employment pay stubs/Tax returns, account statements

Calculate your current debts and monthly bills

In this step, you’ll need to calculate all of your monthly expenses, bills and debt payments. This included such as :

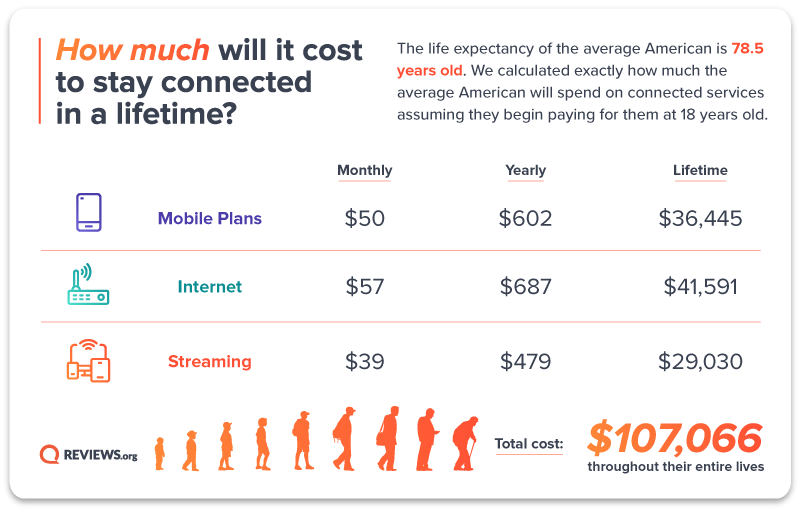

- Re-occurring monthly bills such as electricity, phone, internet, streaming services such as Netflix, Audible, Spotify, Amazon Prime

- Credit card debit

- Student loans debit

According to Zdnet.com, the average consumer surveyed spends “$273 per month on subscription services, up from $237 in 2018.” In fact, according to reviews.org, you could spend up to $107,000 USD on mobile phone, internet and stream services throughout your lifetime.

Are you surprised about your debts? Take the time to examine your expenses. Can you make cuts to your current expenses?

Determine how much of down payment you can make

In this step, you’ll need to consider how much of a down payment you can afford.

How much is the typical down payment?

A standard down payment is typically 20%, but this amount can vary. By investing this much upfront, you can avoid mortgage insurance and will lower your monthly payments.

Benefits of making a larger down payment

For one, they increase the total amount of the home you own from day one and decrease the amount you will need to borrow. A larger down payment reduces mortgage payment and shortens the term of loan. Two, they also show the lender you have some money put away and they will be willing to offer you better rates considering how much you can put down.

Read more: Save for a Down Payment

Get your credit report

Did you know that Credit score is typically the biggest factor in determining interest rates?

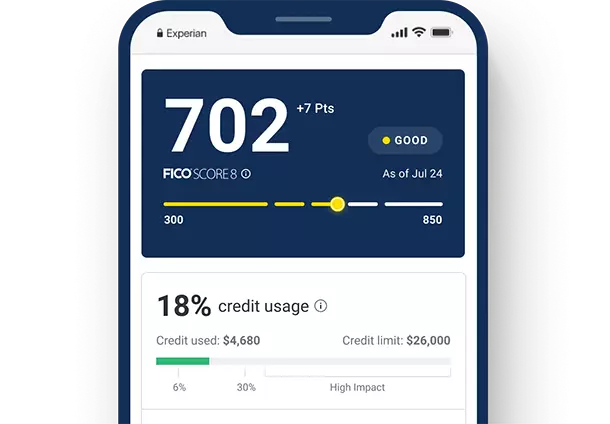

A credit score is a number between 300–850 that depicts a consumer’s creditworthiness. The higher the score, the better a borrower looks to potential

You can get your credit score from the following companies for free

- Experian – Get your credit report, FICO score, for free. No credit card needed.

- Rocket Credit Score

- MyFico

- Equifax

What should you do if you have a low credit score?

A low credit score makes it harder to get a credit card or mortgage—and if do get one you will pay higher interest rates.

Repairing your credit score takes time. Thankfully, there are several companies that can help you improve your score.

- RentReporters helps you increase your credit score by reporting on-time rental payment history to the credit bureaus. After adding their rent to their credit file, customers have been an average credit score increase of 40 points in 10 days.

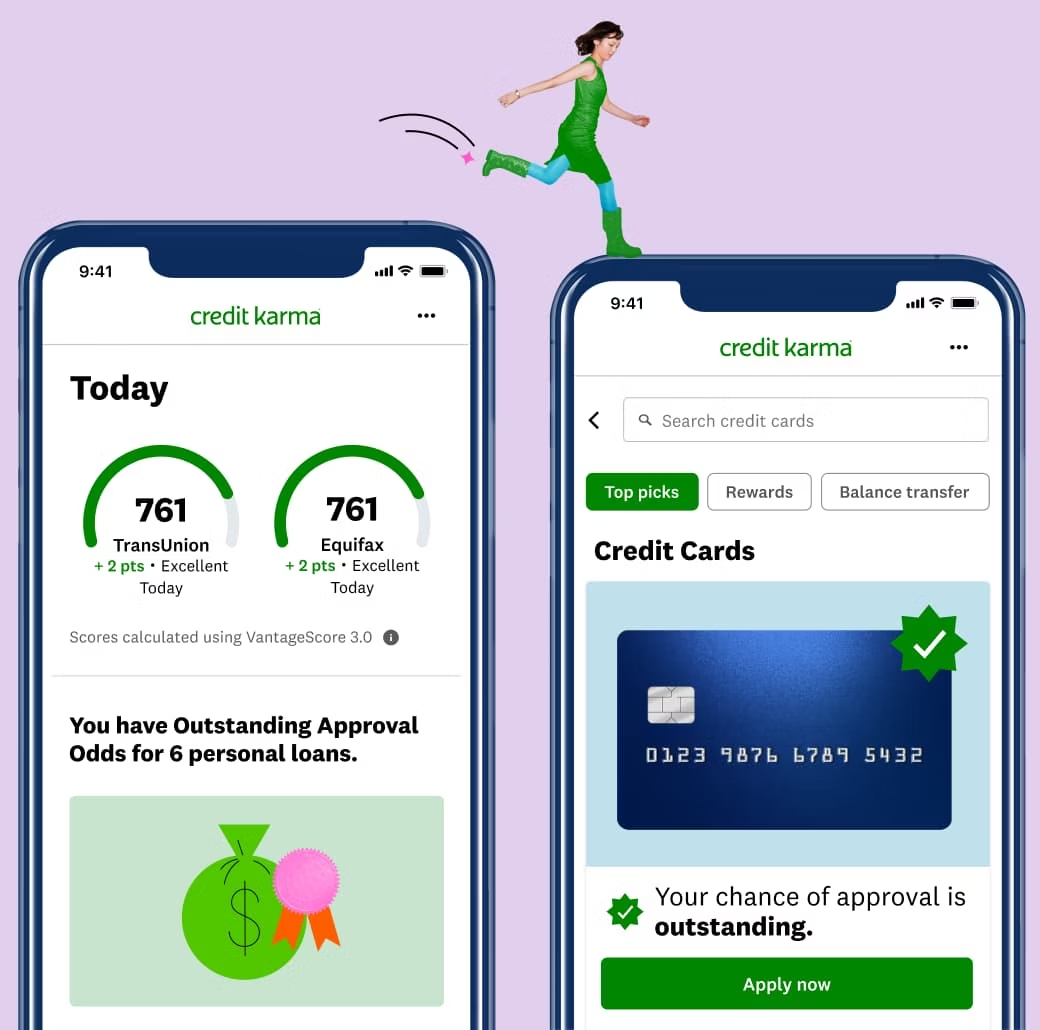

- Credit Karma uses your credit profile to show you curated credit offers for loans and credit cards. Plus, with Karma Confidence, you can see your Approval Odds before you apply, without impacting your scores.

- National Debt Relief provides free, no-obligation debt relief consultation.

More: Increase your credit score up to 40 points in 11 days

Know your rights

Some countries require fair housing practices. This means that lenders cannot discriminate based on your gender or race.

- Fair Housing: Equal Opportunity for All – brochure

- Real Estate Settlement Procedures Act (RESPA)

- Borrower’s rights

- Predatory lending

- Best Practices In Real Estate Loans

Next Steps: Get Pre-approved

Most sellers will not entertain an offer until you have been pre-approved by a lender. Before you make any offers – and really before you start a serious home search – you need to know how much the bank is willing to give you.

Read Next: Choose A Lender and Get Preapproved For A Mortgage

Additional Resources for United States